Two-Wheelers, Two Taxes, One Bad Idea

Rohit Paradkar

Updated: September 01, 2025, 02:50 PM IST

A proposed GST split threatens to fracture India's two-wheeler industry and stall its global momentum for the sake of a problem that may not even exist.

A new Goods and Services Tax (GST) proposal may divide the two-wheeler industry, potentially disrupting a sector that makes a significant contribution to the Indian economy. This raises questions about whether the policy addresses a genuine problem or undermines the international reputation of Indian two-wheeler manufacturers and the nation's aspirations.

India loves its two-wheelers. Not just as a matter of preference, but of necessity. They are the real public transport for millions - cutting across class, geography, and generation. They're frugal, versatile, and form the very foundation of our "Make in India" initiative, a government program designed to promote local manufacturing and boost the Indian economy.

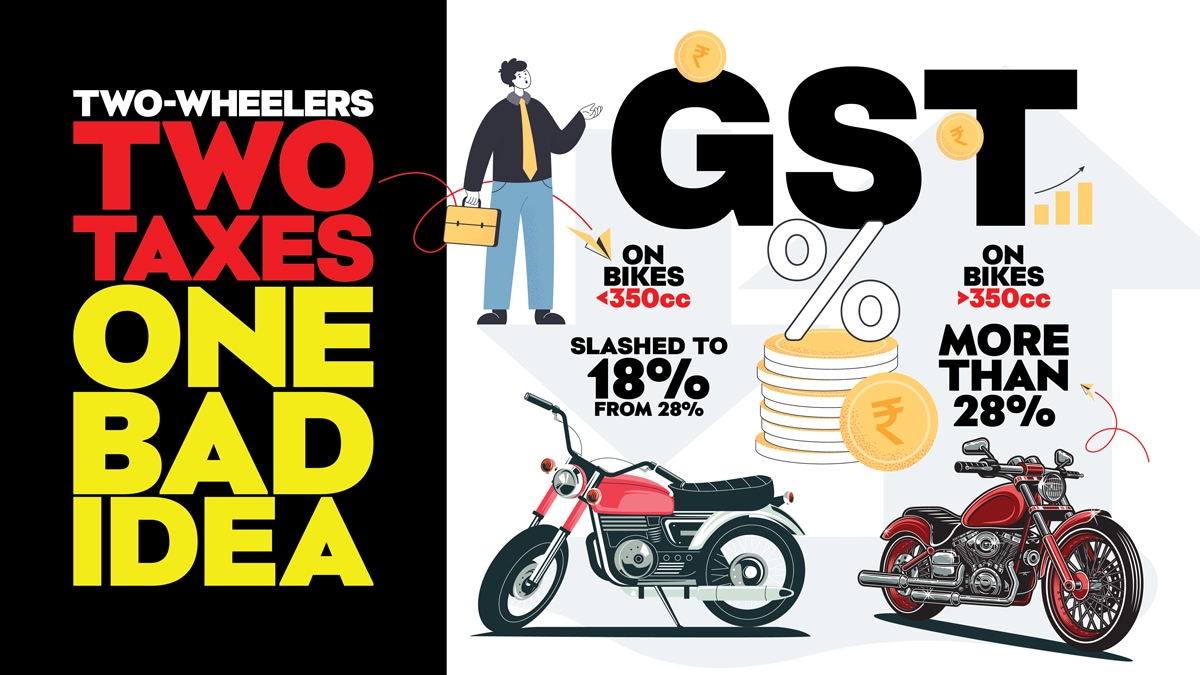

So when the GST Council sits down on September 3rd to discuss a proposal that could drastically alter how two-wheelers are taxed - slashing GST on bikes below 350cc from 28% to 18%, but potentially raising it above 28% for those over 350cc - you can bet the ripple effect will be felt far beyond the boardrooms of Pune, Chennai, or Gurugram.

On paper, the move appears to be a populist masterstroke: reducing the tax on mass-market bikes to make them more affordable. But scratch the surface, and this split-GST logic starts to look like a classic case of policy built on perception, not perspective.

First, let's discuss the numbers. Bikes above 350cc account for just 12% of the total two-wheeler sales in India. So, even if the GST rate on these is increased to, say, 40% or more, the revenue impact is minimal. But the damage to perception, investment, and ambition? That could be massive.

As Siddhartha Lal, CEO of Royal Enfield, rightly put it, "A punitive GST on >350cc would relegate us to smaller-capacity two-wheelers and undermine Indian brands' ability to build strong dealer networks and brand equity worldwide."

In other words, it's not about what we sell today. It's about what we're building for tomorrow.

The Global Implications of the GST Proposal.

India isn't just a two-wheeler superpower - we are the world's largest manufacturer and exporter. The big difference? We aren't exporting commuter 100cc bikes anymore. We're sending out 350s, 400s, and even 650s wearing Indian badges, rolling on Indian tyres, powered by Indian tech. And they're winning.

Just ask riders in Europe buying the KTM and Triumph 400s, made by Bajaj in Chakan. Or ask the Americans checking out the Royal Enfield Himalayan. Or Malaysians throwing a leg over the TVS Apache 310. This is where the narrative matters.

India has finally become aspirational in the premium mid-capacity segment - and now we want to send those bikes back to luxury-tax territory? Why aren't we ever allowed to aspire?

Rajiv Bajaj doesn't mince words. He's not thrilled by the proposed split, and for good reason. "Even 18% GST is significantly higher than the global average of 12%. This division between bikes above and below 350cc is arbitrary and penalises a segment that's already tiny."

He goes further, warning that while the 18% cut for sub-350cc bikes is welcome, it should apply across the board. Anything else complicates the market and holds back both innovation and affordability in the premium segment.

And he's not wrong. This isn't a country where people are buying 400cc motorcycles to show off in South Bombay or South Delhi. These are everyday machines for enthusiasts across Tier 2 and Tier 3 cities - often their only vehicle, not their second or third.

Hero's Take? Unsurprisingly Diplomatic.

Hero MotoCorp, which recently discontinued its only bike above 350cc (the Mavrick 440), has no skin in the premium segment. So their statement reads like a corporate namaste:

"This progressive step will offer relief to first-time buyers... especially in rural and semi-urban areas."

While this statement is accurate, it is noteworthy that the company currently does not offer any models that would be adversely affected by the proposed tax changes.

The Bigger Danger: Stunting Growth by Penalising Aspiration.

The government's view of two-wheelers above 350cc as a luxury doesn't align with the reality in India. These vehicles often replace cars, offering a more practical and affordable solution in a country where road space, parking, and traffic are constant challenges. The sorry state of public transport adds further burden that necessitates owning private transport.

Punishing riders for wanting a little more performance, better stability, or a machine they can ride across states without turning into pulp - feels short-sighted. Especially when those very bikes are helping India punch above its weight on the global stage.

"By delivering exceptional value, we are drawing riders worldwide to shift from larger, higher-displacement machines to Indian-made mid-size motorcycles," Lal said in his plea.

Why then would we want to throttle this momentum?

This policy decision represents a missed opportunity to encourage innovation and growth in the industry. Alternative tax criteria, such as emissions, technological advancement, or intended use, could have been considered instead of engine displacement.

What We Should Do Instead.

Suppose we genuinely want to support the two-wheeler industry and maintain India's edge in global markets. In that case, we need a simplified, uniform GST regime for all two-wheelers - ICE or EV, commuter or cruiser.

18% is a start. 1215% might be closer to ideal. But what's clear is this: splitting GST based on 350cc is lazy policymaking. It's like deciding tax rates for cars based on boot space.

We need a policy that understands the market, rather than just segmenting it. Here are policy alternatives that promote growth and technological progress without penalising displacement:

- Uniform GST Across the Board

A flat rate (e.g., 12?18%) helps the industry plan investments, innovate, and stay globally competitive. - Green or Tech?Linked Incentives

Offer tax cuts for 2Ws with low emissions or advanced safety features to encourage sustainable innovation. - Subsidies and R&D Credits

Provide targeted support for companies developing advanced materials, electric powertrains, or software upgrades - aligning with future-focused mobility.It's rare to see Bajaj and Royal Enfield on the same side of a policy debate, but here we are. When both agree that the proposed GST split is flawed, it's worth paying attention.The objective is not to favour a particular brand or engine capacity, but to prevent India from becoming a market limited to small motorcycles for domestic use while reserving larger models exclusively for export. Motorcycles are mobility. They're manufacturing. They're aspiration. And they deserve better than a tax slab built on engine size and guesswork.

Related Stories

Advertisement

Advertisement

Top Stories

Advertisement

Latest Videos

Most Popular

Advertisement

Network18 Updates

Compare