Mahindra First Choice Wheels: India's used car market is growing at 15 per cent

Mahindra First Choice Wheels, the multi-brand pre-owned vehicle arm of Mahindra and Mahindra, has released the 'India Pre-Owned Car Market Report'. It is a first of its kind study which analyses the used car market in India and also compares it to that of the United States and China. Additionally, the study provides varied details pertaining to the scale and structure of the India pre-owned car market.

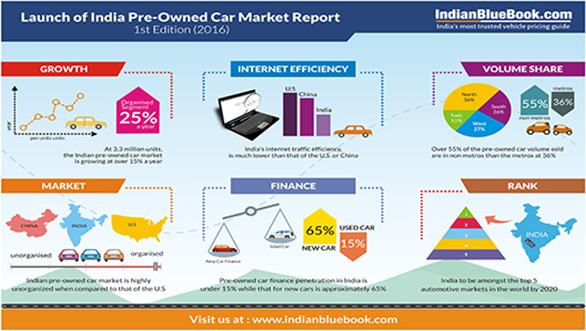

As per the findings of the study, India is likely to become one of the top five global automotive markets by 2020. The 3.3 million pre-owned car market is currently growing at over 15 per cent per year. The organised used car segment is growing at over 25 per cent a year. Currently, 45 per cent of used cars are sold in the metro cities while the non-metros account for 55 per cent of the used car market. Majority of the used cars i.e. 36 per cent are sold in the northern part of the country while the western and southern regions account for 27 per cent and 26 per cent. The used car market in the eastern region is a much smaller and concentrated in a few areas. It accounts for 11 per cent of the total used car market.

In terms of the overall used car market structure, the organised market commands a 12 per cent share, the semi-organised market commands a 35 per cent share while the unorganised market has a 19 per cent market share. The consumer to consumer market has a 34 per cent market share. In comparison to the automobile market of the United States, India's motorization rate is at 22 cars per 1000 people while in the U.S. it is 800 cars per 1000 people. One similarity between both markets is that the used car market is larger than the new car market. The study also found that the Indian used car market is highly unorganised when compared to the U.S. but more organised than that of China.

"Over the last 24 months the pre-owned vehicle industry has been the subject of much attention from variety of industry stake holders such as investors, automotive OEM's, car dealers, financial institutions and consumers. However little is specifically understood about the industry due to severe paucity of data. This first of its kind report should be extremely useful to all stake holders in assessing the Indian pre- owned vehicle industry both domestically and in the global context." said Dr. Nagendra Palle, managing director & CEO, Mahindra First Choice Wheels Ltd.

Currently 50 per cent of used car buyers are in the 25-34 years age group. Typically, the average age of a used car at the time of sale is four years. The primary reasons for people in India to choose a used car is affordability followed by value-for-money. Another interesting finding of the study is that for 55 per cent of used car buyers, it is the first car in the family. There is a lot of growth potential for the Indian used car market especially in terms of vehicle financing. The used car finance penetration in India is below 15 per cent while for new cars it is around 65 per cent.